help us to analyze the health of the business.

HNEW AVERAGE INVENTORY FORMULA DRIVER

Inventory is one of the main driver various aspects of financial statement and analysis. So if inventory is reducing, it means products are selling so less cash has required an increase in inventory means we need more cash The budgeting team analyzes the change in inventory and estimates what cash will be required for inventory for the future. Similarly, it is also helpful in budgeting.The concerned inventory team analyze the change in inventory on each type i.e raw material, WIP and finished products and take necessary actions to manage it properly It is also used for better inventory management.From the formula above, we can see that we can use the change in inventory to find out what is the COGS for that particular period.There are several reasons why inventory change is calculated: Usually, inventory change is calculated on a monthly or quarterly basis. It is also used for budgeting and to determine future working capital requirements. This is very useful to check how well the business in managing its inventory. Like it is explained above, inventory change is basically the difference between ending and beginning period inventory. Total Sold Inventory = Average Cost * Units SoldĮnding Inventory = Total Inventory – Total Sold Inventory

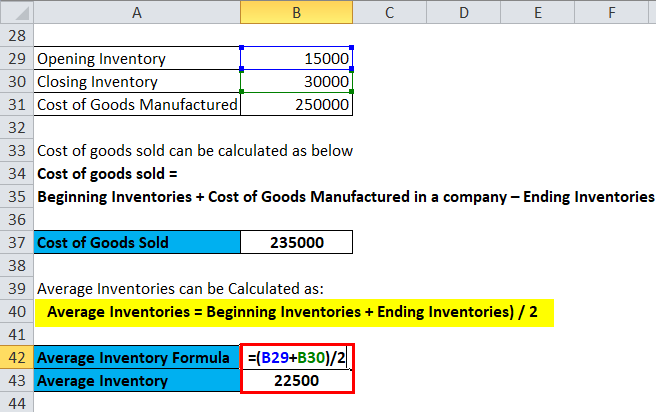

Total Sold Inventory is calculated using the formula given below Let say that the company has sold 15 units and they are left with only 5 units of inventory Company has made a few purchases in month 1 and 2 in this inflationary environment. The market environment is inflationary which means that prices of the unit are increasing in the market. Let say a company XYZ has beginning inventory of 10 unit with a unit price of $10 per unit. Let only take the inflationary environment in the picture to understand all three methods Now let see another example to find ending inventory using FIFO, LIFO and Weighted average method. Below is the data table:Įnding Inventory is calculated using the formula given belowĮnding Inventory = Beginning Inventory + Inventory Purchases – Cost of Goods Sold During the remaining financial year, the company has made purchases amounting 20,000 and during that time, on the company’s income statement, the cost of goods sold is 40,000. Let say company A has an opening inventory balance of 50,000 for the month of July.

HNEW AVERAGE INVENTORY FORMULA DOWNLOAD

You can download this Inventory Formula Excel Template here – Inventory Formula Excel Template Inventory Formula – Example #1 Let’s take an example to understand the calculation of Inventory in a better manner. Ending Inventory is then calculated by the average cost per unit by the number of units available at the end of the period.Įxamples of Inventory Formula (With Excel Template) Weighted Average Cost Method: In this method, the average cost per unit is calculated by dividing the total value of inventory by the total number of units available for sale.So if the market environment is inflationary, ending inventory value will be lower since items which are purchased at a lower price are part of ending inventory LIFO (Last IN First OUT) Method: In this method, items which are purchased last will be sold first and the remaining items will be the old purchases.So if the market environment is inflationary, ending inventory value will be higher since items which are purchased at a higher price are part of ending inventory FIFO (First IN First OUT) Method: In this method, items which are purchased first will be sold first and the remaining items will be the latest purchases.There are 3 different ways of calculating ending inventory: Add the new purchases and subtract the Cost of goods sold Methods For Calculating Ending Inventory So to calculate ending inventory for the period, we will start will the inventory which is currently listed on company’s balance sheet. This happens because of various reasons like inventory lost, stolen inventory, etc. Any difference between the counted inventory and inventory on a balance sheet is called “shrinkage”. In order to make ensure inventory records are accurate and up to date, businesses usually take an inventory count at the end of each quarter or year. Inventory can be finished goods, Work in process goods or raw material. The reason is that it is expected that it will be sold in the coming months. Inventory is part of a company’s balance sheet and in categorized under current assets. So basically, businesses produce goods to sell in the market and the products which are still lying with the business is part of the inventory. Inventory, in very simple terms, is basically products, goods, raw material which are not utilized by the business and expected to be used. Examples of Inventory Formula (With Excel Template).

0 kommentar(er)

0 kommentar(er)